Sarborg

Agentic Signature Intelligence

Sarborg is an agentic AI signature intelligence business, built on the principle that signatures can function as a universal data language to identify, interpret, and generate high-value opportunities across multiple sectors. By analysing, matching, and learning from biological, chemical, and industrial signatures, Sarborg’s agents create a continuously evolving network of intelligence-driven insights.

Executive Overview

Sarborg is a technology-driven company integrating advanced AI agents, mathematical algorithms, and cybernetic systems to optimize complex decision-making processes.

At its core, Sarborg is an agentic AI signature business, built on the principle that signatures can be used as a universal data language to identify, interpret, and generate high-value opportunities across diverse sectors. By analysing, matching, and learning from biological, chemical, or industrial signatures, Sarborg’s agents create a continuously evolving network of intelligence-driven insights.

Key Benefits of Signature-Based Intelligence

Signature-driven analysis removes manual interpretation and subjectivity, ensuring consistent and reproducible outputs. By adopting a data-first approach to signature comparison, the process avoids traditional assumptions and reduces bias, delivering cleaner and more objective insights. Automated scoring accelerates the identification of high-value opportunities and significantly shortens research timelines.

The methodology is inherently scalable, applying seamlessly across pharmaceuticals, agriculture, bacteriology, oil and gas and other sectors. Through advanced signature matching, the platform uncovers non-obvious patterns and novel concepts that would not be detectable through conventional analytical methods.

Benefits

- /001Eliminates Human Error and Subjectivity

- /002Reduced Bias and Cleaner Signal

- /003Faster Decision Making

- /004Scalable Across Sectors

- /005Reveals Previously Invisible Opportunities

Signature-Based Approach

Signature Agent

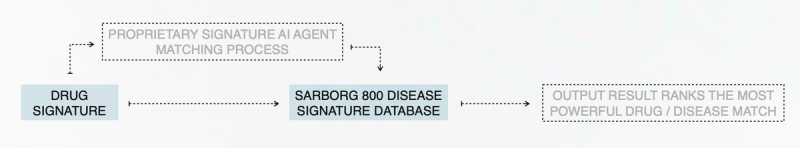

Sarborg’s patent pending (No.63/981,801) Signature Agent uses proprietary AI to analyze drug and disease signatures, generating a compatibility score to identify high-potential repurposing, combination, and discovery opportunities across drug portfolios —enabling data-first decisions with unmatched speed.

Sarborg’s first deployment applies drug–disease signature modelling in pharmaceuticals, with expansion underway into additional sector-specific signature domains.

High-level agent process diagram, further details are available upon execution of NDA

AI-Powered Matching

Proprietary algorithms score drug-disease signature similarities, prioritizing the strongest therapeutic potential.

Scalable Application

Supports both Sarborg’s internal pipeline and client portfolios.

Comprehensive Data Integration

Incorporates genomics, connectivity mapping, and the Sarborg 1,600 (gold-standard disease signatures) for unbiased alignment.

Actionable Outputs

Shortlisted assets ranked for value unlock, licensing potential, or further development.

Novel Opportunity Detection

Flags overlooked repurposing candidates, synergistic combinations, and de novo discoveries.

Precision-matched signatures drive higher success rates - from discovery to deployment.

Multi-Agent Platform Overview

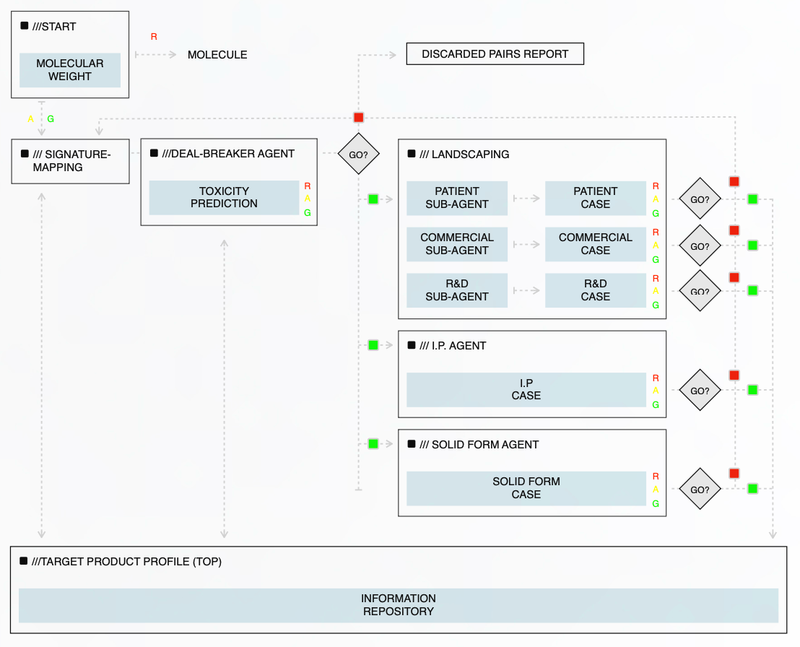

The illustration displays the multi-agent platform architecture, which constantly evaluates pharmaceutical assets to identify potential opportunities for Sarborg to take forward.

Importantly, pharmaceuticals represent Sarborg’s initial proof of concept, not its core limitation. Sarborg is fundamentally a signature-based platform, and the same signature agent architecture applies wherever robust signatures exist. Beyond pharmaceuticals, Sarborg is actively expanding into additional sectors, including:

- Agrichemicals

- Bacteria

- Peptides

- Oil and Gas

- Others

Deal-Breaker Agent

Screens for partnership-critical risks.

Landscape Agent

Analyzes therapeutic opportunity maps

Solid-Form IP Agent

Optimizes formulation & patentability.

Commercial & R&D Agents

Assess TAM, pipelines, competition.

IP Landscape Agent

Ensures freedom-to-operate

The Team

Dr. Andrew Regan

Dr. Andrew Regan is a Saint Barths based British born polar explorer and entrepreneur. He is the founder and Chief Executive Officer of Corvus Capital.

Dr. Regan sold Hobson Plc in 1996 for £154 million by way of a recommended cash takeover. In the years after the sale of Hobson Plc, Dr. Regan continued to invest in a number of public and private companies and was a founding shareholder in ASOS, Imperial Energy, IB Daiwa and others, which each achieved valuations in excess of $1 billion.

In 2014 he was awarded a PhD for his research in writing and developing a bio-inspired algorithm for forecasting the financial markets. His thesis was “A system to predict the S&P 500 using a bio-inspired algorithm” which forecasted tomorrow’s (t+1) directional trend of the S&P 500 at 55.1% accuracy. This algorithm used a novel parallel processing approach using GPUs. Since then, Dr. Regan has written a number of additional algorithms using an implemented agentic approach.

He is passionate about the polar regions and is an accomplished polar explorer having led a number of expeditions to both the Arctic and Antarctica.

Mr. Craig Wigglesworth

Dr. Hitesh Sanganee

Dr. Hitesh Sanganee has spent over two decades working across all aspects of drug discovery and development. He has supported a myriad of innovations across dermatology, neuroscience, oncology and rare diseases, driven by his mission to see his projects benefit patients. He also remains an active contributor to the life sciences ecosystem, with experience on the board of Apollo LLC (formerly Apollo Therapeutics) as well as the investment committee of life sciences VC, CMS Ventures.

He has been a leader in pursuit of next-generation therapeutics discovery, exemplified as a key instigator in AstraZeneca’s Open Innovation platform, building relationships and sharing resources and knowledge with external researchers leading to funded start-ups across multi-omics, AI and drug discovery.

A recognised thought leader, he was voted among Asia Tech’s Top 100 Innovators in 2021. Hitesh holds a DPhil and BA in Chemistry from the University of Oxford, and an MBA from the University of Cambridge.

Hitesh is currently at Octopus Ventures as a part-time Venture Partner to support the Biotech team, following his previous position as Executive Director and Global Head of Emerging Innovations at AstraZeneca.

Dr. Ben Readhead

Dr. Ben Readhead is the Edson Endowed Professor of Dementia Research at Arizona State University’s Banner Neurodegenerative Disease Research Center. A physician-scientist and computational biologist, his research integrates genomics, biomedical informatics, and systems biology to advance therapeutic discovery for neurodegenerative diseases, with a focus on Alzheimer’s.

His work employs two complementary approaches: disease-centric strategies that construct multiscale network models from multi-omics data to decode causal mechanisms of neurodegeneration, and therapy-centric methods that harness computational drug repositioning to identify novel applications for existing treatments. A key pillar of his research investigates the role of infectious agents such as herpesviruses and the brain microbiome in Alzheimer’s pathogenesis.

Dr. Readhead earned his Bachelor of Medicine & Surgery from the University of Western Australia and has contributed to translational projects across neurology, oncology, and rare diseases.

Dr. David Weston

Dr. David Weston is a seasoned Life Sciences Strategy leader with over 12 years of experience spanning pharmaceuticals, biotechnology, and management consulting. Specializing in R&D innovation, he has spearheaded large-scale transformation initiatives for global biopharma companies, leveraging cutting-edge technologies such as artificial intelligence, quantum computing, and advanced data analytics to accelerate drug discovery and development.

David combines deep scientific expertise with strategic business acumen, holding a PhD in Neuroscience from the University of Cambridge and an Executive MBA from London Business School. His cross-functional background enables him to bridge the gap between scientific innovation and commercial strategy, delivering measurable impact across the life sciences value chain.

Value Creation Strategy

Sarborg has created a unique structure with three separate arms to maximize value creation…

Client Services

Through its signature-based intelligence, Sarborg partners with companies to identify new opportunities that are tailored to a businesses needs, in return for a fee.

These services, delivered through Sarborg's proprietary signature and multi-agents, assist in key deliverables such as drug repurposing, asset management, and clinical trial optimization. Our solutions are designed to accelerate decision-making, reduce costs, and enhance R&D outcomes across the pharmaceutical value chain.

Equity Partnerships

Prior to approaching potential partners, Sarborg leverages its proprietary AI agent processes to analyse the drug portfolios of mid-sized, disease-agnostic pharmaceutical companies.

Where strong potential is identified, Sarborg initiates engagement by presenting its findings and outlining possible collaboration pathways. In return, Sarborg selectively takes economic benefits on identified asset opportunities that align with its strategic vision and demonstrate the capacity to benefit from advanced AI-driven capabilities.

Owned Intellectual Property

Using a structured multi-AI agent platform that evaluates a multitude of inputs. Sarborg goes beyond traditional drug repurposing by creating new intellectual property (IP) and superior pharmaceutical products through its proprietary solid-form engineering and formulation strategies. Once IP is generated, Sarborg conducts small animal studies and uses the data derived to out-license assets for royalty and milestone payments.

Delivering on Our Strategy

Since launching in November 2024, Sarborg has rapidly advanced its dual-track value creation model.

- Secured and delivered mandates across its Client Services division, building durable, recurring partnerships.

- Developed eight proprietary solid-form IP candidates with the potential to extend asset life by up to 20 years, subject to regulatory approval.

- Designed and deployed its proprietary patent pending (No.63/981,801) Signature Agent, supported by additional agents and multi-agent architectures to optimise strategic decision-making.

Inflection Points To-date

- /001Client Mandates Secured & Fulfilled

- /002Revenue-Generating Client Arm Operational

- /003Dual-Track Model Executed

- /004Proprietary Agents Developed & Patent-Pending

- /005Long-Duration Patent Optionality Created

Client Services

Client Services Overview

Equity Partnerships / JV’s

Sarborg employs a unique, AI-first approach to Joint Venture (JV) partnerships

By Investing in these partners, Sarborg:

- /001Enables fully autonomous, AI-Driven decision making (eliminating human intervention bottlenecks)

- /002Secures Sustainable revenue streams tied to partner success

- /003Accelerates sector-wide innovation in pharmaceutical technology

This strategy creates lasting value for partners and shareholders alike while advancing AI adoption across the industry.

Proactive Portfolio Analysis

Prior to any engagement, our proprietary AI agents analyze the drug portfolios of mid-sized, disease-agnostic pharmaceutical companies, identifying high-value opportunities for technological integration.

Structured Economic Alignment

Where strong potential is identified, Sarborg:

/// Presents its findings to demonstrate collaboration potential

/// Selectively negotiates either:

/// Long-term equity stakes in partner companies, or

/// Economic benefits on specific asset opportunities aligned with our strategic vision

Value Creation

These partnerships are exclusively formed with companies that:

/// Have demonstrated compatibility through prior use of Sarborg's client services

/// Exhibit potential for industry leadership via AI-driven strategies

Sarborg's joint venture model identifies high-potential pharma assets, structures flexible equity/revenue partnerships, and accelerates value through autonomous execution - transforming portfolios in weeks, not years.

Portfolio Analysis & Identification

Our proprietary AI agents analyze mid-sized pharma portfolios to:

/// Identify undervalued assets with repurposing potential

/// Score drug–disease matches using the Sarborg 800 signature database

/// Flag high-priority targets for partnership

Present & Structure JV Partnership

Sarborg presents AI-validated opportunities with two pathways:

/// Equity Stake:

Long-term ownership in partner companies

Board-level collaboration on AI-driven R&D

/// Asset-Specific Deal:

Revenue share on repurposed drugs

Milestone payments for validated candidates

Execution & Value Acceleration

Partnerships enable:

/// Autonomous Decision-Making:

AI optimizes development pipelines in real-time

/// Scalable Revenue:

Royalties from partnered assets + equity upside

/// Sector Leadership:

Joint IP creation and accelerated market entry

Owned Intellectual Property

Owned IP: AI Agent Based Approach

Sarborg leverages proprietary AI agents and cybernetics to identify, develop, and partner pharmaceutical assets with unmatched speed, precision, and commercial upside.

/001 Identify

Multi-agent platform identifies repurposing, discovery & combination opportunities using >70 structured criteria — reducing human bias, academic friction & cycle time.

/002 Enhance

Once a candidate has been sourced, through our Cybernetics & solid-form strategies optimize formulation, generate new IP, and prepare for regulatory & partnering readiness.

/003 Out-license

Small animal studies de-risk the asset. Data packages support licensing deals with milestone & royalty potential for Sarborg and its clients.